Gas price skyrockets, huge power cuts, lesser power generation, coal deficit, etc. etc. These serious causes are having significant implications on business, governments and central banks. While moving with full-throttle towards sustainability, and net-zero policies; we have actually left behind one of the most crucial consequences – inflation. This inflation, rising from transition of an economy to a sustainable/green economy is termed as ‘Greenflation’.

through 2050 (compared to October 2021, %)

(Source: NatWest)

Globally, everyone is facing an emerging paradox amidst their transition. The more they push towards greener future, the harder the things are getting to achieve them. Campaign becomes more expensive and resources, apparently exhaust rapidly. And the cherry on the cake was the Covid-19 pandemic. The glitches in supply-chain and fund management being affected, new policies and rules have even made it harder for a greener transition.

Different Scenarios & Greenflation

On world level, whether it be developed or developing nation, each of them are trying to beat the Greenflation scenario and transit to cleaner economy as early as they can. The European Union (EU) recently lifted the cost of emitting carbon for transportation and manufacturing industries. Moreover, it ditched the sales of conventional gasoline powered cars and slapped carbon levies on trade partners with tighter regulation policies.

Notably, sustainability really hit EU hard. Speed of wind played a key role in post-pandemic situation. German and EU energy demands were increased, while due to low wind speeds, there have been significantly less power generation. And ultimately, less environment friendly, COAL had to be kept in action…

conventional cars (kg per car)

(Source: NatWest)

Meanwhile, demand for gas (LNG) increased immensely as there was a decline in coal suppliers in 2021. As a result, electricity prices were hiked and skyrocketed. Even then, there were frequent power cuts across entire summer and these all resulted into China driving LNG prices in whole of Asia.

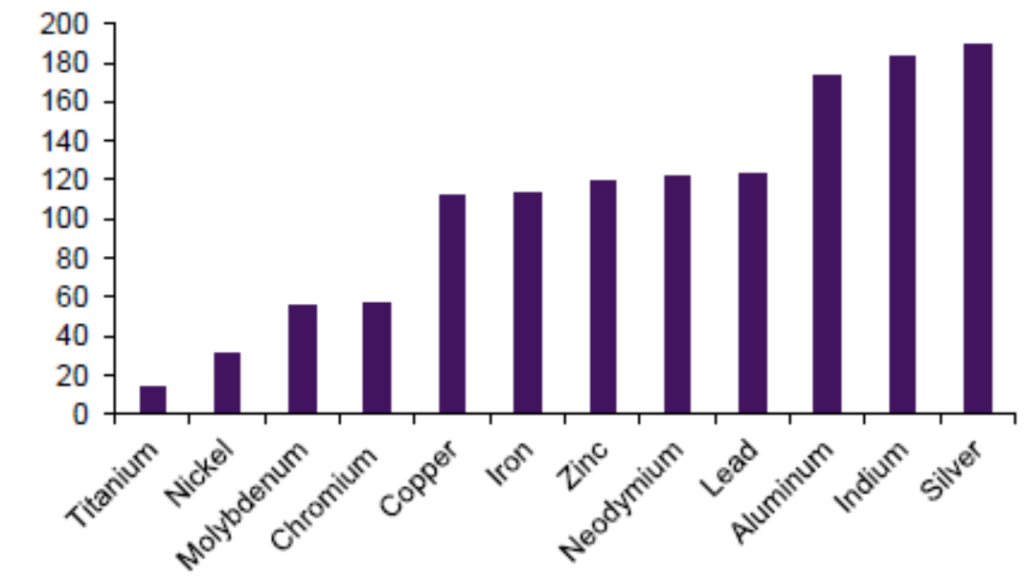

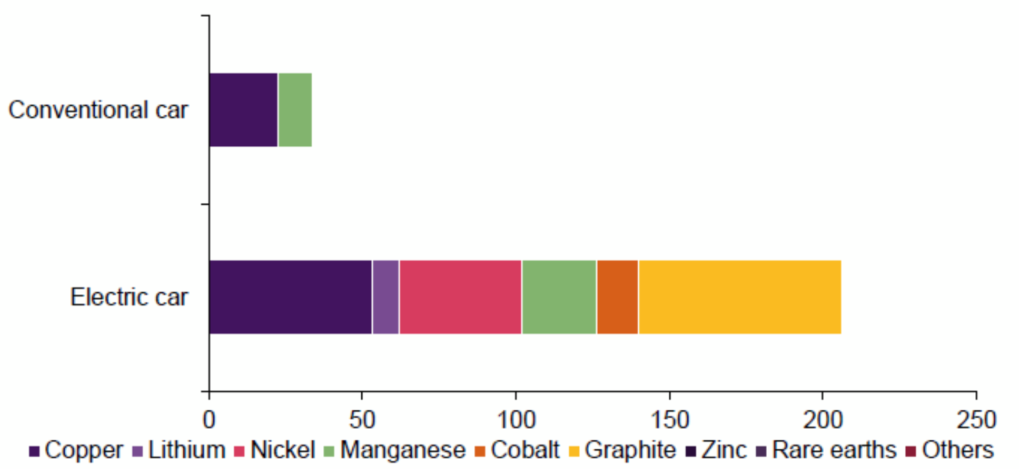

Price of copper has rose more than 70% over the past 3 years, to a record high of $10,724 and currently elevated at about $9000. Similarities in prices of palladium and nickel can be observed. And importantly, these are some of the crucial ingredients on chip manufacturing and largely used in automobile industries. Well, on this note where we are speculating things, one more is there. Currently, we use primary metals in the production of an EV battery, which can reduce emissions by only a quarter. If we recycle rather than digging new, it can reduce emissions by about 80%. Remember, we are speculating!

Risk. Economy. Greenflation. Future

To be honest, renewable and sustainable technologies require more wiring than fossil fuels do. Green technologies like wind turbines and electric vehicle batteries require higher amounts of certain materials (copper, aluminium, lithium), which increases demand when investments in traditional mining could be limited (due partly to the globalisation of ESG policy).

on Greenflation and its consequences

(Source: Garrigues)

One way to better understand the impact of Environmental, Social and Governance (ESG) on prices in a sustained way is to look at how minerals needed for green technologies perform against a broader basket of commodities. As, businesses, governments, and markets double-down on ESG, one would expect the price of minerals needed for green technologies – everything from wind turbines & solar panels to electric vehicles – to come under pressure and command a premium.

Take Tesla for instance. Yes, the Elon Musk company. Its dominance in US market provides decent proxy for EVs. On an average Tesla price have increased by over 6.3% compared to 5% seen in new cars during the same period. Higher mineral prices and perhaps stronger demand may have resulted in higher inflation for EVs, though the differential doesn’t seem that significant in the context of much higher mineral prices.

Higher Inflation for Broader economy? Is Greenflation Permanent?

The fear for Greenflation is compounding. While the world is emerging from the pandemic period, many economists have speculated that high inflation rates will be less temporary than most central bankers have planned. It is clear that transition from fossil fuels is going to be messier than we think. Policymakers and governments need to make unpopular and harsh choices, that most are desperate to avoid. People will be forced or will be needing to change their lifestyles, significantly.

This all will evolve huge and steady additional costs that nations are not willing and will be unable to bear. They will be juggling between times when there will be unprecedented amounts of debt, lesser tax revenues and endless competing claims on hard-pressed budgets.

[…] India will also be a point of attraction. Major issues to be discussed at the summit will be Greenflation, climate fair share, climate ambition, climate finance, loss and damage leverage, and carbon […]